AVITA Medical (NASDAQ: RCEL, ASX:AVH) had a very successful 2022, and by all accounts, the momentum has carried into 2023. Revenues of the RECELL® System, including sales to BARDA, totaled $34.4 million in 2022. Revenues of $9.5 million in the fourth quarter of 2022 exceeded consensus expectations and increased by 36% over the same period in 2021. Throughout 2022, we saw increased penetration and utilization among its core market of U.S. burn centers, as well as international expansion into Japan through its partners.

Financial guidance for the full year 2023 is for total revenues between $49 and $51 million, which at the mid-point of this range equates to a 45% increase over the full year 2022. Guidance for the first quarter of 2023 is for revenues between $10 and $11 million, which represents a 5% to 15% increase sequentially over the fourth quarter of 2022.

In 2023, we expect growth to be driven by a number of factors, including continued higher penetration and utilization in the U.S. burn center market, expansion into new accounts, and two potential approvals to expand the RECELL label into the treatment of vitiligo and soft tissue repair. The U.S. FDA has awarded Breakthrough Device Designation for RECELL for both of these indications, which expedites the approval process. Thus, a decision from the U.S. FDA on both indications is expected in June 2023. In the meantime, the company is expanding its sales force from 30 to approximately 70 professionals. This should be in place by the end of the second quarter of 2023, in time for the pending soft-tissue launch in July 2023.We also received approval for a new Ease of Use device in 2022 that should help facilitate uptake in these new market opportunities.

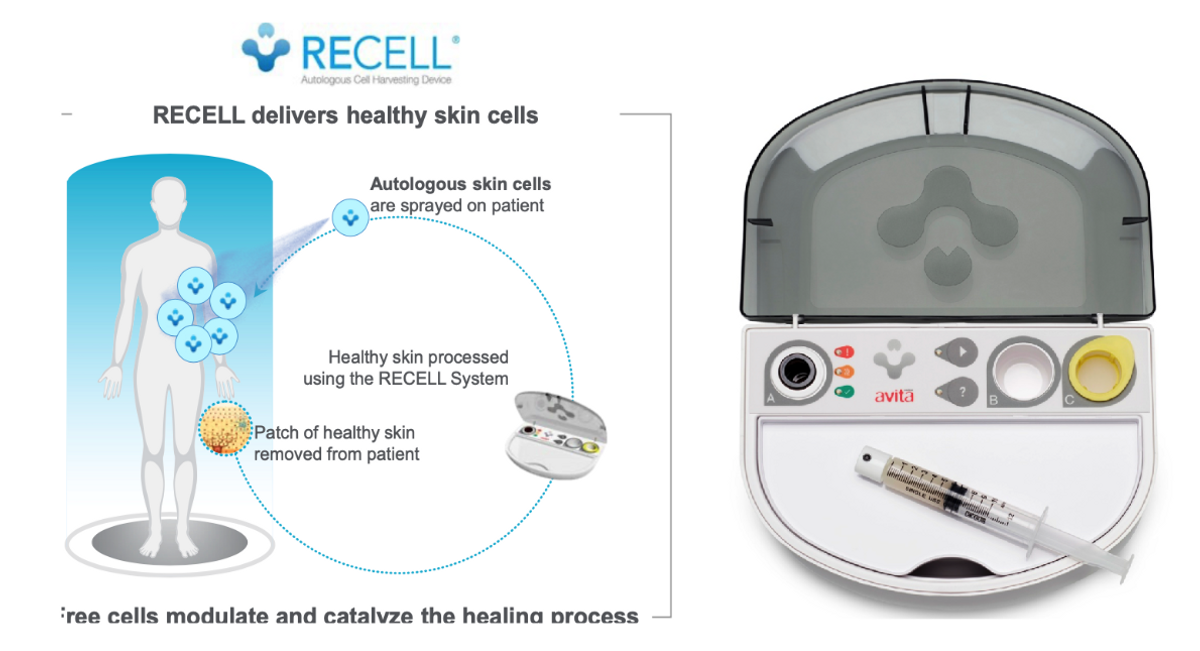

The RECELL® System Autologous Cell Harvesting Device U.S. FDA approved for the treatment of acute thermal burn wounds. The kit comprises a proprietary enzyme formulation, a processing unit that includes three chambers, a heated, sterile enzyme soak, a buffer rinse, and a filtering chamber. Preparation of the sample is a three-step process that takes approximately 25 to 30 minutes.

RECELL addresses several challenges associated with treating deep partial-thickness (2nd degree) and full-thickness (3rd degree) burns, including donor site pain, availability of healthy donor skin, reduced number of procedures, reduced length of hospital stay, and lower cost. Clinical data show that using the RECELL System significantly improved donor site healing and reduced scarring compared to split-thickness skin graft (STSG). In addition, the pivotal studies leading to the RECELL System’s FDA premarket approval for the treatment of acute thermal burns demonstrated that the RECELL System treated burns using 97.5% less donor skin when used alone in second-degree burns and 32% less donor skin when used with autograft for third-degree burns.

The Spray-on-Skin® technology allows for skin cells to be applied with broad and even coverage over the entire wound bed. The isolated skin cells include keratinocytes, fibroblasts, and melanocytes, which play a critical role in tissue regeneration and wound healing. As a result, RECELL results in superior definitive closure and wound healing, along with earlier discharge and a reduced number of follow-up procedures versus STSG alone. It’s a win for the burn center because it reduces cost and increases revenue potential (by treating more patients). And it’s a win for the patient because evidence shows dramatically improved patient experience, including significantly less reported pain.

Commercial sales of the RECELL System in 2022 totaled $34.4 million. We increased guidance for the full year 2022 to $33 to $34 million after the third quarter report, up from the previous guidance of $30 million, and they still exceeded both consensus and guidance when they reported the full-year results in February 2023. The increase in revenues year-over-year was driven by increased penetration into the burn market, both with existing and new customers, as well as initial revenues coming from sales in Japan with partner COSMOTEC following the PMDA approval in February 2022 and finalization of coverage reimbursement in September 2022.

In February 2022, we gained FDA approval for a new RECELL System with improved ease of use. The enhancements provide clinicians with a more efficient user experience and simplified workflow. The previous RECELL System consisted of multiple individually packaged sterile components requiring transfer into the sterile field and required clinicians to rely on multiple people to assist during the process. The new RECELL System modification reduces set-up steps by approximately one-third and enables the use of the device with reduced support personnel. This is particularly important in an ongoing/post-COVID environment where medical centers and patient care facilities have lingering staffing issues. AVITA Medical launched the new kit in 2022, and management has noted that the new ease-of-use device has allowed the company to increase penetration at some of its larger accounts. We are also working on a new fully-automated device that should be commercial-ready in 2024. This will be instrumental in helping them penetrate the dermatology market in 2025.

Another key event that took place in 2022 was the appointment of James Corbett to CEO in September 2022. Mr. Corbett has a tremendous background and experience that should help drive the company forward in the coming years. We have also been working to enhance its Board of Directors, appointing two new non-executive members, Cary Vance and Robert McNamara, effective April 1, 2023.

AVITA Medical completed two separate PMA regulatory filings to the U.S. FDA on soft tissue repair, which includes both surgical/reconstructive wounds and traumatic or chronic wounds, and vitiligo, on December 12th and December 19th, respectively. As noted above, the U.S. FDA awarded the RECELL System Breakthrough Device Designation for both indications in November 2022. This helps expedite the review process, and the company is expecting a decision on both indications in June 2023.

Assuming they win approval - and we believe the odds are excellent for both - AVITA Medical should be in a position to launch into the soft tissue market immediately (guidance is July 1, 2023). As noted above, we are now in the process of expanding its sales force from 30 to 70 full-time professionals. Importantly, reimbursement codes currently in place for the burn market can be leveraged to facilitate reimbursement in soft tissue. Expansion into the soft tissue market presents a tremendous area of growth for the company. AVITA Medical is currently targeting only large U.S. burn centers - around 150 of them - with its current sales force. This is approximately 25,000 patients and predominantly where all of the current $34 million in sales are taking place. Subsequent to obtaining label expansion into soft tissue repair, AVITA Medical expects to expand its promotional efforts to ~1000 Level-1 trauma centers in the U.S., which not only includes another 10,000 burn patients but potentially as many as another 120,000 soft tissue repair procedures. That’s a 5-fold expansion of the market opportunity coming online as soon as July 2023.

AVITA Medical is also expecting approval for the treatment of stable vitiligo in June 2023. Recall, in September 2022, we reported that the pivotal trial in stable vitiligo achieved its primary endpoint of superiority, with 56% of the RECELL treatments resulting in repigmentation of more than 50% of the treated area versus only 12% of the control (narrowband UVB phototherapy). For the vitiligo indication, AVITA Medical is in process of pursuing in-office reimbursement through the AMA CPT code process. This is separate from the burn/soft tissue code. Management believes they can secure Medicare reimbursement by January 2025. During the interim period, RECELL will be available by cash pay and physician-sponsored studies. We expect that the roll-out in vitiligo will be slow until 2025, but we are eager to see how the new fully-automated device helps facilitate uptake in 2024 nevertheless.

And beyond soft tissue and vitiligo, we are keeping an eye out for updates on the work the company and collaborators are doing with genetically-modified skin cells that could allow for next-generation opportunities in aesthetics or orphan skin diseases, such as epidermolysis bullosa.

AVITA Medical exited 2022 with $86 million in cash and investments. During the fourth quarter of 2022, the gross margin was 86%, and the net loss decreased to only $5.4 million, a decline of 37% compared to the same period in 2021. Adjusted EBITDA decreased by 39% year-over-year to only $4.0 million in the fourth quarter of 2022. So while not yet profitable, we are clearly heading in the right direction. Revenues are going up, and burn is coming down substantially. We forecast that both revenues and costs will increase in 2023, but we believe that the company is on track for positive EBITDA by the end of 2024. Based on guidance for revenues in 2023 and our forecasted operational expenses, we believe AVITA Medical has sufficient cash today to make it into 2025, which is projected to be the first full year of cash flow-positive operations for the company.

AVITA Medical has built a better mousetrap for the skin grafting market. RECELL is currently approved for burn, and we see excellent potential that the label could be expanded to include soft tissue injuries and vitiligo in June 2023. Sales for the treatment of burns in the U.S. are ramping, and substantial new opportunities should come online for the second half of this year. As noted above, the market opportunity in soft tissue opens up a potential 5-fold expansion. Longer-term, we are particularly excited about the opportunity in vitiligo, where the current unmet need is high and AVITA Medical’s new fully-automated device could represent a paradigm shift for dermatologists starting in 2025.

AVITA Medical is a regenerative medicine company leading the development and commercialization of devices and autologous cellular therapies for skin restoration. The RECELL® System technology platform, approved by the FDA for the treatment of acute thermal burns in both adults and children, harnesses the regenerative properties of a patient’s own skin to create Spray-On Skin™ cells. Delivered at the point-of-care, RECELL enables improved clinical outcomes and validated cost savings. RECELL is the catalyst of a new treatment paradigm and AVITA Medical is leveraging its proven and differentiated capabilities to develop first-in-class cellular therapies for multiple indications, including soft tissue repair and repigmentation of stable vitiligo lesions.

* Use of non-GAAP Measure

AVITA Medical’s reported earnings are prepared in accordance with generally accepted accounting principles in the United States, or GAAP, and represent earnings as reported to the Securities and Exchange Commission. AVITA Medical has provided in this release certain financial information that has not been prepared in accordance with GAAP. AVITA Medical’s management believes that the non-GAAP adjusted EBITDA described in the release, which includes adjustments for specific items that are generally not indicative of our core operations, provides additional information that is useful to investors in understanding AVITA Medical’s underlying performance, business and performance trends, and helps facilitate period-to-period comparisons and comparisons of its financial measures with other companies in AVITA Medical’s industry. However, the non-GAAP financial measures that AVITA Medical uses may differ from measures that other companies may use. Non-GAAP financial measures are not required to be uniformly applied, are not audited and should not be considered in isolation or as substitutes for results prepared in accordance with GAAP.

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “intend,” “could,” “may,” “will,” “believe,” “estimate,” “look forward,” “forecast,” “goal,” “target,” “project,” “continue,” “outlook,” “guidance,” “future,” other words of similar meaning and the use of future dates. Forward-looking statements in this press release include, but are not limited to, statements concerning, among other things, our ongoing clinical trials and product development activities, regulatory approval of our products, the potential for future growth in our business, and our ability to achieve our key strategic, operational, and financial goal. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the timing and realization of regulatory approvals of our products; physician acceptance, endorsement, and use of our products; failure to achieve the anticipated benefits from approval of our products; the effect of regulatory actions; product liability claims; risks associated with international operations and expansion; and other business effects, including the effects of industry, economic or political conditions outside of the company’s control. Investors should not place considerable reliance on the forward-looking statements contained in this press release. Investors are encouraged to read our publicly available filings for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this release, and we undertake no obligation to update or revise any of these statements.